Excel is a powerful tool for financial analysis, and it offers several functions to help calculate returns on investments. Three of the most useful for capital budgeting and investment analysis are IRR, XIRR, and MIRR. These functions allow you to calculate the rate of return on cash flows, which is essential for assessing the profitability of projects and investments. In this article, we’ll break down each function and explain how and when to use them.

1. IRR (Internal Rate of Return)

The IRR function in Excel calculates the internal rate of return for a series of cash flows that occur at regular intervals (usually annually). It assumes that the cash flows are evenly spaced over time.

Syntax

=IRR(values, [guess])- values: The range of cells that represent the series of cash flows (positive and negative).

- guess (optional): An initial estimate for the rate of return (Excel will use 0.1 or 10% by default if not provided).

Example

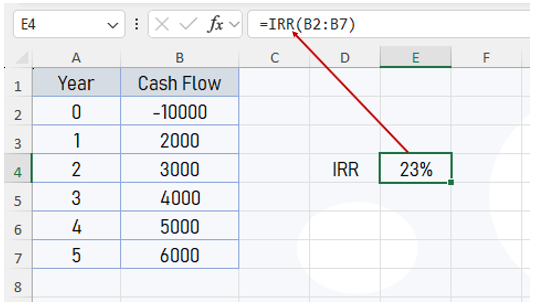

Assume you have the following cash flows starting with an initial investment of -$10,000, and the subsequent returns over 5 years:

In E4 cell, use below given formula to calculate IRR.

=IRR(B2:B7)Excel will return the internal rate of return, which in this case might be around 23%.

When to Use IRR

- IRR is useful for evaluating investment projects where cash flows occur at regular intervals.

- It is best suited for assessing the profitability of projects with evenly distributed cash inflows and outflows over time.

Limitations of IRR

- IRR assumes that all intermediate cash flows are reinvested at the same rate as the IRR itself, which can be unrealistic in some cases.

- For projects with irregular cash flows or changing discount rates, IRR can give misleading results.

2. XIRR (Extended Internal Rate of Return)

Unlike IRR, the XIRR function allows for irregular intervals between cash flows, which makes it more flexible in real-world scenarios where investments don’t always follow a strict timeline.

Syntax

=XIRR(values, dates, [guess])- values: The range of cash flows (positive and negative).

- dates: The corresponding range of dates for each cash flow.

- guess (optional): An initial estimate for the rate of return.

Example

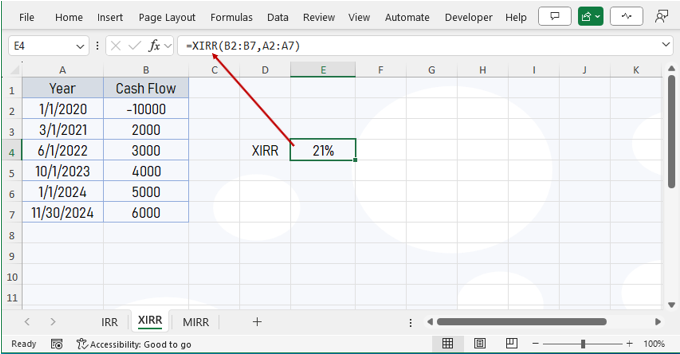

Using the same cash flows as the previous example, but with specific dates:

You can use the following formula:

=XIRR(B2:B7, A2:A7)Excel will return the extended internal rate of return based on the irregular timing of cash flows.

When to Use XIRR

- XIRR is most appropriate when cash flows do not occur at regular intervals.

- It’s often used for investments or projects where the payment or return schedule is uneven, such as stock dividends or bond payments.

3. MIRR (Modified Internal Rate of Return)

The MIRR function improves upon the IRR function by addressing one of its main weaknesses: the assumption that all cash flows are reinvested at the IRR rate. MIRR allows you to specify both a finance rate (cost of investment) and a reinvestment rate for the cash flows.

Syntax

=MIRR(values, finance_rate, reinvest_rate)- values: The range of cash flows (positive and negative).

- finance_rate: The interest rate you pay for the money used in the investment.

- reinvestment_rate: The interest rate at which you reinvest cash flows.

Example

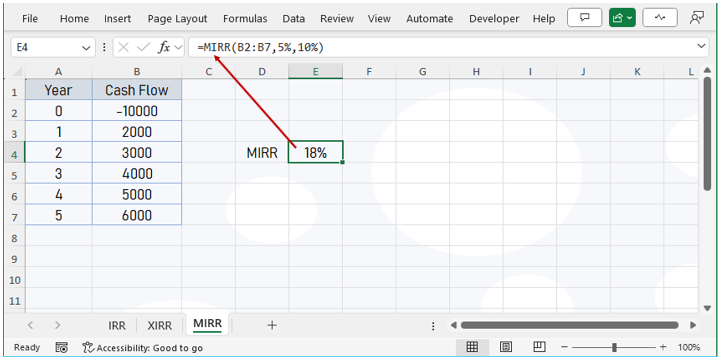

Using the same cash flows as before but assuming a finance rate of 5% and a reinvestment rate of 10%:

=MIRR(B2:B7, 5%, 10%)Excel will return the modified internal rate of return, which accounts for the differing rates of borrowing and reinvesting.

When to Use MIRR

- MIRR is useful when you want a more realistic evaluation of a project, particularly when the reinvestment of cash flows is not expected to occur at the IRR rate.

- It’s commonly used in capital budgeting, especially for projects where reinvestment rates differ from the project’s cost of capital.

Advantages of MIRR over IRR

- MIRR provides a more accurate reflection of the cost and potential return of an investment.

- It overcomes IRR’s unrealistic assumption about reinvestment rates, making it more useful for practical applications.

Conclusion

Each of these Excel functions serves a specific purpose when it comes to calculating returns on investments:

- Use IRR when cash flows are regular, and you want a simple rate of return.

- Use XIRR when cash flows are irregular and spaced unevenly over time.

- Use MIRR when you need to account for differing reinvestment and financing rates.

By understanding these functions and their appropriate use cases, you can make more informed decisions about the profitability and potential returns of your investments.